This post may contain affiliate links, view our disclosure policy.

This article takes a look at the recent trend of travel hacking and explains in detail how you can begin saving hundreds of dollars on family travel flights and accommodations.

Most of us love the thought of traveling together as a family, but oftentimes feel limited by the price tag that comes with it. Believe it or not, there are many people who have actually found a very simple way to save big bucks on family travel.

Though we may want to jet off to a tropical destination or book a fabulous hotel for a weekend getaway, the reality is that sometimes our possibilities are limited because of how much it costs.

For this reason, I am so excited to feature guest writer Alex’s article, Beginner’s Guide to Travel Hacking right here on Travel With A Plan!

Alex is a busy wife and mom of three little boys who

“I have a love of travel but don’t love the price tag that comes

Alexalong with it. Does anyone?! Here, I’ll teach you everything I’ve learned about how to travel for nearly free. My goal is to keep itsimple, becauselets be honest, who has time for complicated?

What is Travel Hacking?

Travel hacking is traveling for free or at a very low cost by using miles and points you have collected through credit card signups.

The idea is that you sign up for a credit card, complete the minimum spending requirement, get the points, redeem the points for flights and/or hotels, go on a nearly free vacation, and repeat!

Sounds easy enough right?!

Well, maybe it is a tad more complicated than that, but not much!

Let me walk you through the basics.

What is a credit card sign up bonus?

Credit card issuers want you as their customer.

In order to entice you, they offer bonuses.

For example, if you sign up for a card and spend $3,000 in 3 months they may give you 50,000 points. These points are then worth at least $500 in travel and sometimes more like $1,000 in travel!

Meeting Minimum Spend

Your minimum spend is the amount of money the credit card company states you must spend on the card in a given time period (usually three months) in order to be awarded the sign-up bonus.

You might be wondering how to meet that spending requirement, especially on cards that require a higher amount.

First, pay for all your normal everyday expenses (groceries, gas, internet, cable, etc.) with the credit card. I never use cash and it would pain me to do so. Why use cash when I can get 1.5-5% back on all my purchases if I use a card?!

As a mom of three, it’s pretty easy to hit the 3K minimum spend (I’m looking at you Costco and Amazon) by using my card for my everyday purchases.

I also plan my credit card applications around a big purchase.

Planning on buying new furniture? Have a medical or dental procedure coming up? Going to be doing some Christmas shopping?

Those are all great times to open a card because you know you will be spending more than normal, especially a card with a higher minimum spend.

Annual Fees

It is important to note that many of these cards include an annual fee. Some will charge that fee in the first year but the value of the points will usually far outweigh the fee.

Luckily, many of them don’t charge that fee until the second year. At that point it is important to evaluate if you want to keep that card or not.

There are three options you have when that first year of card ownership comes to an end.

- Keep the account open and pay the annual fee. Example: I keep my Hyatt card and pay the annual fee because it comes with a free night. The fee is a less than I would spend on a hotel night, making it worth it to me.

- Downgrade the card to a no annual fee card. Example: We didn’t want to pay the annual fee on my husband’s Chase Ink Business Preferred card again so he called the number on the back of his credit card and asked if he could downgrade to the Chase Ink Cash which does not have an annual fee. Stay tuned for a post all about downgrading and why it can be beneficial.

- Cancel the card altogether.

Before you do, ask them if they have any retention offers (this is where they offer you points to keep the card) or would be willing to waive the annual fee. You can decide from that point if the offer is worth it to you. And if they don’t offer anything then cancel.

Keep in mind, you should keep the card the whole first year.

The credit card company won’t like it if you cancel your card right after you get your points. In fact, the fine print on many applications says if you close your card within 12 months of acquiring it they can take your points away.

I always let my annual fee for the second year post and then I call in, close the card, and they reimburse that annual fee.

My Travel Hacking Strategy

First, I talk with my husband about where we’d like to go on vacation (well actually, I just tell him where we are going).

Then I look into what airlines will get us to that destination and what hotels the area has to offer.

Once I decide on a hotel brand and airline, I look into what cards will give me the points needed to cover those expenses.

I open one card at a time.

I put all the spending that I possibly can onto that card. After I receive the bonus for the card, then we move onto the next one to accumulate all the necessary points. Once I have all the points we book and then we are off!

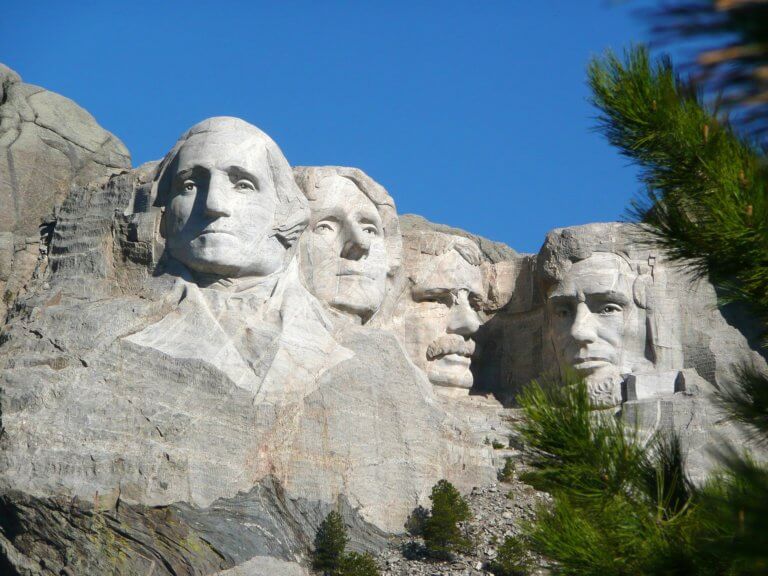

There are a lot of variables that determine how many cards it will take to get you your nearly free vacation, but just to give you an idea… you could plan a trip for 2 to Hawaii using 3-4 cards and a trip NYC to meet up with your girlfriends for 1 card.

Just like saving up money for a trip, it takes a little time to save up your points. Depending on your spending habits you could expect it to take around 6-9 months to have the points to book a Hawaii trip.

If you are like me, you will find that once you get into this, the points start coming in and that timeline will go down.

Two Player Mode When Travel Hacking

Two-player mode is when you and your spouse are both signing up for cards in your own name. By doing this you are able to get a lot more points and get the same card twice.

You are also able to refer each other to cards to get more points.

This is what it looks like: Mitch signs up for the Chase Sapphire Preferred and earns 50,000 points. After we meet the minimum spend and are ready for a new card he refers me to the card.

I apply and am approved, which earns Mitch another 10,000 points. I meet the spend on my new Sapphire Preferred card and earn 50,000 points.

Now instead of just 50,000 Ultimate Reward points we have 110,000 (plus the points you earned for each dollar you spent on the card)!

Chase 5/24 Rule

In short, the Chase 5/24 rule says if you have opened 5 or more new credit cards in the past 24 months, from any bank, you will not be approved for a new credit card from Chase.

This includes Chase co-branded card like United, Southwest, and Hyatt cards.

If you are an authorized user on a card that can also count against your five cards (which is why Mitch and I never make each other authorized users).

Because of this rule, I recommend starting with Chase cards.

Another thing to keep in mind is that most business cards don’t count towards your 5/24 count, however if you are over 5/24 you won’t be approved for Chase business cards. For some of you this won’t be a big deal, but if you get going in this hobby it’s important to be aware so you can have a plan.

It is also important to know the term because it gets tossed around in the travel hacking world quite a bit.

Is this for me?

It is critical that you only get into this hobby if you can pay off your card in full each month. If you are paying interest then you really aren’t getting a free vacation but are getting debt instead.

You also want to have a good credit score. You need to be responsible and organized.

How does this affect my credit score?

This is a common concern, and I get it. Credit is an important thing! The following five things each make up a portion of your credit score:

- Payment history, 35% (Do you pay on time?). This one shouldn’t be a problem. Remember, you are only getting into this if you can pay off your card each month on time and in full!

- Credit Utilization, 30% (How much of your credit you are using). This one is helpful for us

travel hackers! It is better to have $100,000 of available credit and use $5,000 each month vs. having $5,000 in credit and using it all every month. - Age of Credit Accounts, 15% (The average age of all your credit accounts). This

one will affect everyone differently. Having some older accounts on your report is going to help a lot. It won’t make opening up new ones a big deal. Keep those older accounts open! If you don’t have some older accounts on your credit report then opening new cards will affect you more. - New Inquiries, 10%. Opening a lot of new accounts in a short period of time will cause your credit to drop a few points. This is short-lived, however.

Mix of Accounts, 10%. Basically how diversified is your credit? House loans, car loans, credit cards, etc. I feel like the positives outweigh the negatives on this or at least cancel them out. That being said I am not a financial expert. But I can tell you that since my husband and I started doing this our credit score has gone up and we are both over 800.

Now head on over and check out my travel guides to see how all this comes together!

Alex

*Before leaving, be sure to check our Travel Resources Page to help with your travel planning. Find exclusive travel discounts, and book hotels, rental cars, and guided tours.*